…and how it all comes together.

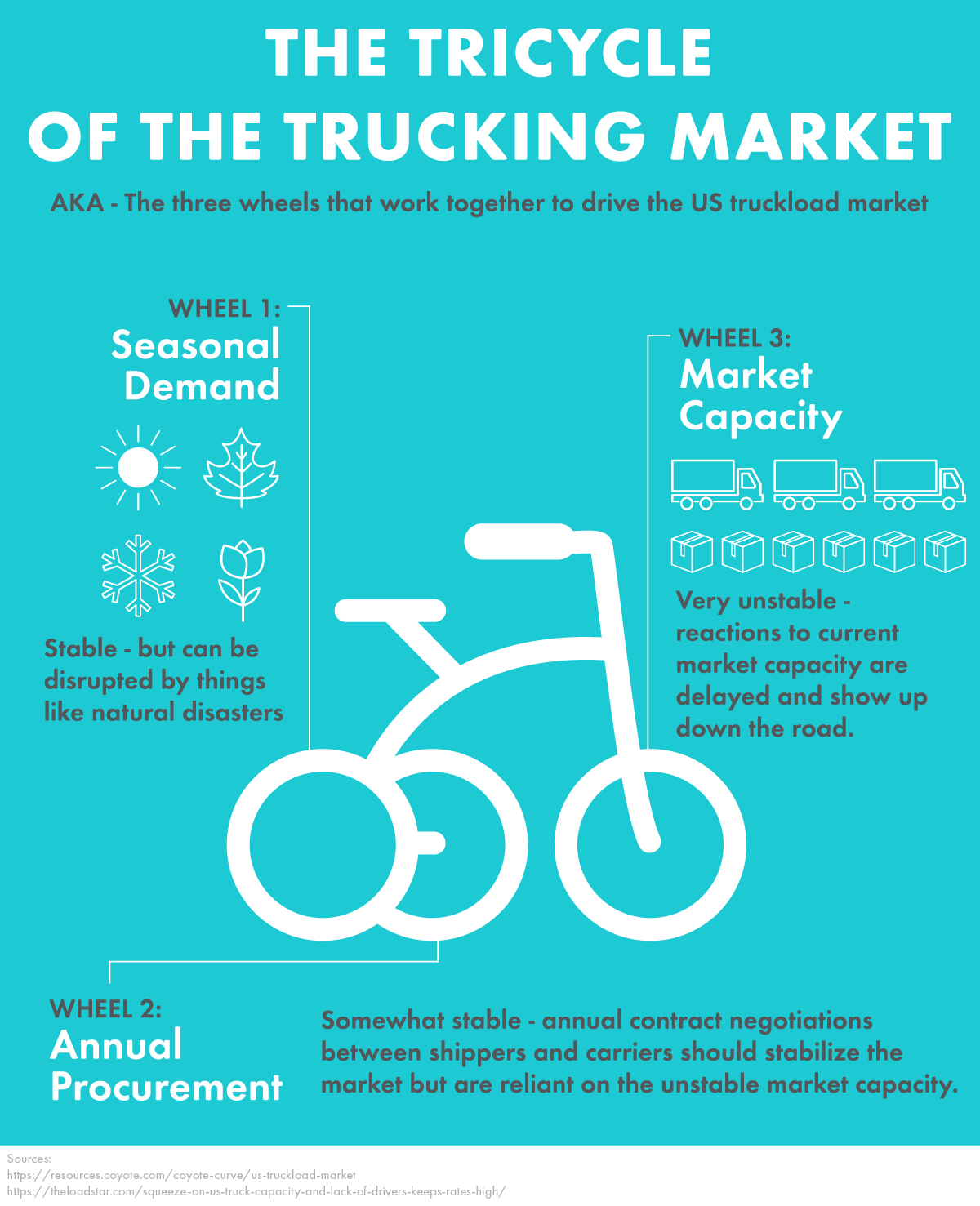

We recently, briefly, covered how supply and demand are the basic driving forces of the U.S. trucking market. And yes, that pun was intended. If supply and demand are the pedals, then today we’ll look at the wheels of the tricycle of the trucking market, the three pieces working together to keep everything upright.

Wheel #1: Seasonal Demand

Just like the predictable turning of the leaves in the fall, the market has its predictable surges dependent on the time of year. The nation isn’t ordering Christmas trees en masse in July, so it’s safe to say we don’t need to plan for that—come November and December though, the market should be ready to absorb the extra load. As we said, predictable. This wheel is the most stable of the tricycle. However, unpredictable interruptions, such as hurricanes in the summer or blizzards in the winter, can cause major disruptions to this cycle.

Wheel #2: Annual Procurement

Most high-volume shippers have contracts with carriers that include set rates, saving them from the volatility of rates on the spot market. However, most of these contracts get put up for bid every year in order to reset against the overall changing market.

While it seems like this wheel should be a steady one, forecasting rates in order to propose or accept a bid from either side, shipper or carrier, is an unsure practice. Relying on the shifting supply and demand structure, an interdependent three-cycle system, and everyone trying to protect their own finances makes for one tricky procedure.

Wheel #3: Market Capacity

Say there are 10 trucks on the road but 100 trucks worth of freight to move. Rates reflect that situation; the market is operating in a tight capacity and everyone reacts accordingly. In order to alleviate the situation, a push is made to hire more drivers. This takes a little time but sure enough, a few months later, there are 80 trucks on the road. However, now there are only 50 trucks worth of freight to move. Basically, the market makes large swings from one side to the other because of delayed outcomes to actions taken during previous market situations. Coyote tracks and predicts these market swings with their proprietary spot rate index, the Coyote Curve.